Solomon Philip is Shift Technology’s Head of Market Intelligence

An increasing number of Fraud, Waste, and Abuse (FWA) cases are critical issues facing health insurers and third parties dealing with health claims on behalf of insurers. At the same time, the investigative resources required to ensure the integrity of health payments are being stretched thin. More people in the United Kingdom than ever before have Private Medical Insurance (PMI), with 25% more of us purchasing a policy last year alone to avoid the long post-covid NHS queues and get treatments quicker*. With this surge in new policies, and thus claims and investigations that follow, how do health insurers address improper payments and meet regulatory requirements without access to a sizable and medially trained investigation team? The only answer is to arm investigative teams with powerful AI capabilities. These technologies allow insurers to increase efficiencies across their limited resources and focus efforts toward detecting FWA and changing behaviours.

The Issue at Hand

Potential fraud is often spotted by a few experienced front line staff using intuition, as a result very few of these “quality” cases are passed to the back office to investigate, and even fewer return real savings. Often these referrals are complemented with huge lists of claims that have been produced using rule based searches based on claim value, or time to claim.

Investigation and audit teams are often under-resourced and forced to make decisions on which cases to investigate based on little or no information on the likelihood of successful closure resulting in low fraud detection and poor ROI. As a result the real problem is masked and undetected leakage and the ability to offer competitive premiums becomes increasingly challenging in a high-cost environment.

As important, this is all happening in the midst of a growing highly competitive market where cost becomes the primary differentiator. And as we are all well aware, cost concerns are aggravated when fraud increases. Both prepay and postpay improper payment detection capabilities must become more robust to combat the emerging schemes which are growing in sophistication and severity.

Optimising Costs with AI

In this environment, it is clear that investing in tools and resources for fraud waste and abuse detection and recovery automation makes sense. As previously mentioned, prepay capabilities can often stagnate without necessary investments in postpay resources, thus impairing the team’s effectiveness. Diminished effectiveness and impact are the direct result of the lack of vital reinforcement learning derived from post-pay investigations.

Unfortunately, most insurers are looking to minimise costs and meet regulatory requirements often consider lean investigation teams as a source of cost savings. Prepay investments in tools, technology, and people are viewed as vital in stopping fraud. However, these investments cannot be made at the expense of investing and nurturing investigation teams. Making people or AI technology investments enhances a health insurers’ overall fraud detection machinery. Insurers struggling to optimise costs must look to AI to help drive down costs in postpay while developing comprehensive fraud detection capabilities and taking their initiatives to the next level.

The Total Impact of the Investigation and Audit teams

Showing immediate and significant ROI from audit and investigation activities has traditionally been difficult. Typically, health insurers report experiencing a recovery rate of 0.15% or less . As a result, it is understandable that insurers looking to capture savings may pull resources from their existing audit teams into prepay in an effort to reallocate assets in a manner believed to be more beneficial.

This approach does not address the core issue, ROI offered by investigation and audit teams diminishes further without technology investments. Yet, the results of postpay investigations fuel prepay payment integrity efforts. Without these learnings, payment integrity effectiveness and accuracy diminishes, limiting the benefits that can be realised.

Reliance on rudimentary rules-based pre-pay detection significantly increases the probability of missing the most complex fraud schemes and can increase the amount of false positives, wasting investigation time. Adding further pressure for fast, accurate pre-payment decisioning are contractual obligations payment laws to release payments within stipulated time frames. These financial and reputational impacts on the health insurers brand severely impairs its ability to land contracts with providers, hospitals and corporations. Further, poor brand reputation inhibits the ability of insurers to enable providers to deliver better patient care and reduce provider abrasion.

A New Course of Action

Health insurers looking at all claims in aggregation (both past and present) for networks and connections increase their chances of catching fraud patterns, outliers, and oddities missed when investigating one case at a time, which can cost millions. Instead of managing cases using folders, static documents, and spreadsheets, insurers plans must implement case workflow solutions that increase real-time collaboration, track all claims activities and updates, as well as reduce redundancies or overlooked tasks.

Creating a feedback mechanism leveraging reinforcement learning from post-pay outcomes is also fundamental to a robust fraud detection strategy. Learnings must include insights from internal investigative analysis and tips from external sources. Providing such is an impossibility for a claims auditor or investigator who is only looking for simple flags to accumulate and assess across a large body of complex claims. On average, typical claims cycle time can take two weeks and even months, based on its complexity. Insurers should build an efficient Center of Excellence for investigations and audits with the tools, techniques, and technologies required for efficiency and accuracy, while using AI to automate existing tasks and deploying human resources to investigate complex and higher-value cases from new and emerging schemes. Industry reports indicate that using AI/ML can reduce typical claims cycle times by 50%.

AI’s Role

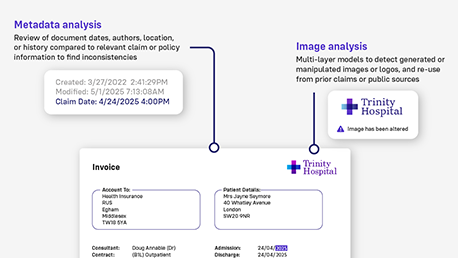

So, how exactly does AI fit into the improper payment and fraud detection strategies of forward-thinking health insurers? Fundamentally, insurers can significantly reduce this investigative process by using AI to replicate the organisation’s “best investigator” at scale while enhancing the quality and leveraging prescriptive and proactive insights into suspect providers, claims, and member behaviour. Optimising investigative resources with AI can further assist health insurers by amplifying the impact of each investigator. AI can learn from alerts and case outcomes and analyse medical records and images to detect inconsistencies and anomalies. AI offers detailed, real-time explanations for each alert which reduces time and redundancies in the investigative process and which a rules-based engine simply cannot do.

Online collaboration amongst team members is also critical to accelerating claims investigation, payment, or denial. Insurers must continue to use existing internal/external data, and add more sources, such as online maps, and even publicly available reviews and social media, to enhance the detection accuracy of AI models. Health insurers can leverage NLP on social media or provider review platforms for sentiment analysis, and document analysis to assist in detecting complex schemes, suspicious relationships, and networks or crime rings otherwise missed by humans or rules engines. Advanced AI in investigation continually allows the prepay workflow process to evolve through reinforcement learning from case outcomes. Using the right AI in post-pay will enable health insurers to apply learnings to pre-pay models, thus avoiding losses, shortening investigation times, and reducing the amount of pay and chasing efforts for false positives.

Conclusion

Health plans can utilise AI to develop fraud detection capabilities in post-pay investigation, and these learnings are fundamental to robust payment audit teams. Health insurers must continue looking at claims holistically, aggregating learnings gleaned from past and present data sources, This ability has proven incredibly difficult for a human or a rules engine to replicate consistently and at scale. Finally, converting teams into Centers of Excellence with tools and technologies needed to automate the capture of existing and emerging fraud, and disseminating these abilities seamlessly across the life cycle of a claim is one of the most effective means of realising immediate ROI for health plans.

Many thanks to Shift's healthcare team for their assistance in developing this post.

For more information about how Shift can help you adopt generative AI to meet the unique challenges facing the insurance industry – contact us today