Shift Subrogation: Recover More with AI-Powered Subrogation

Introduction

Subrogation revenue smooths the volatile chaos brought during uncertain economic times and more frequent natural disasters. At the same time subrogation teams are under pressure. Most insurers are facing technical debt, and for subrogation this may also mean the absence of any technology. Where subrogation technology is deployed, carriers are constrained by knowledgeable resources and limited IT bandwidth to maintain these systems.

Further exacerbating this problem is the talent gap. Subrogation expertise takes years to develop. Handlers acquire knowledge only by working a variety of claims and breadth and depth of knowledge correlates to the claims analyzed. The complexities of comparative negligence and identifying recovery opportunities based on various conditions or states is a skill gained over a long period of time. However, according to the U.S. Bureau of Labor Statistics, employment of claims adjusters, appraisers, examiners, and investigators is expected to decline 5 percent from 2023 to 2033, creating a challenge for insurers to maintain the subrogation revenues.

A highly complex and nuanced practice such as subrogation is ripe for evolution using AI and data-driven, analytical processes. The analysis necessary to identify a recovery opportunity can be executed quickly and with accuracy, while offering consistent interpretation of applicable governing jurisdictions. AI-based subrogation increases subrogation revenue by avoiding missed opportunities using advanced detection capabilities.

Shift Subrogation

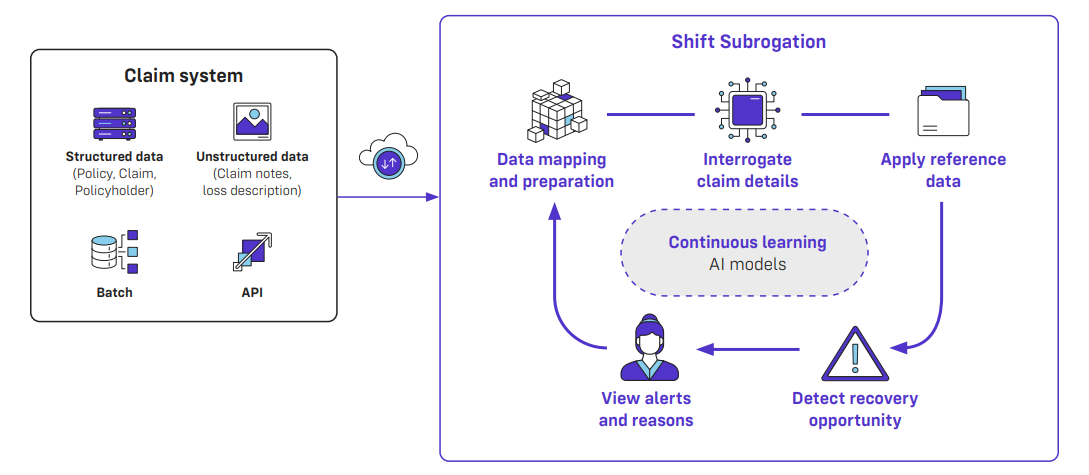

Shift Subrogation is an AI-based SaaS solution that quickly, accurately and consistently identifies potential recoveries. Advanced AI capabilities enhance subrogation detection by analyzing vast quantities of information and data sets related to the claim. The result is an increase in recovery dollars completed faster with greater efficiency.

Claims data preparation

The subrogation detection process begins with claims details provided from the insurer’s claim system. This data contains the policy details, claim details such as parties involved, property or vehicle details and supporting claim notes and documents. The provision of unstructured data in the form of claims notes or adjuster reports, in addition to the standard fields provide the opportunity for the most robust analysis and interpretation.

Shift maps the data provided by the carrier to enable Shift Subrogation to perform the analysis necessary to identify subrogation opportunities. A set of historical data provides the best starting point for analysis and can often reveal new recovery opportunities on claims that have been previously closed without any recovery.

Recovery opportunity analysis

Shift Subrogation analyzes the claim for recovery opportunities by scrutinizing the claims details to assess parties involved and the context and circumstances of the event. The solution quickly and consistently assesses each claim, using the claims details and relevant data and reference sources. Automated analysis using AI drives the discovery of what might otherwise be a missed opportunity if done manually.

Assess claim details

Critical information in both the structured data and freeform text is analyzed using specific insurance models. The Shift Generative AI (GenAI) models enable claims to be classified with a high degree of precision. The sophisticated models parse unstructured data (claim text, insured/claimant statements, etc.) to help estimate liability. GenAI can interrogate virtually any unstructured text it can access. This includes news stories or articles, business or legal documents, or financial summaries or reports. These large language models (LLMs) are capable of reviewing and assimilating the plethora of data that could accompany a claim far faster than a human could analyze.

Shift has conducted significant analysis on LLMs including a comparison of the various LLMs available and improving LLM performance in production environments. Access the latest report, The state of AI in Insurance: a comparison of LLM Performance (Vol. V).

Apply reference data

Data sources such as state-specific comparative negligence rules and local jurisdiction for items such as property type are maintained in the solution for input into the analysis. State comparative negligence laws are maintained by Shift to remain current.

External data access contributes to the recovery analysis and is accessed automatically as determined by the content of the claim. Product manufacturing recall and warning lists are examples of external data that may be included based on GenAI analysis determining that a product may be related to the cause of the incident. In this situation, the product is identified and a URL link provided if that product is located on an external recall list, increasing efficiency for a handler to access and review the details. Various data sources may be employed and are continuously being added. This data is stored locally or accessed using an API.

Data sources validate facts in assessing subrogation viability and identify hard to find PIP exposures. Watch the video.

Detect recovery opportunity

The solution synthesizes the details of the incident including what happened and who was involved to assess parties at fault. Shift maintains a library of line of business, policy type, exposure and loss scenarios that are continuously enhanced. The output is an estimate of liability to provide immediate insight on the recoverability given the circumstance and jurisdiction.

The analysis is refined with detailed analysis of the individual exposures (PIP, Collision, MedPay for auto claims) and (policy details for property claims). These results are based on an analysis of state operator rules, negligence laws, statute of limitations, joint/several rules, SOL, etc - all that are relevant to the specific claim.

The recovery analysis is performed on a batch basis to include all new claims entered in the claim system each day. The output can be made available for handlers to review immediately or set to a delay to allow for further supporting information to be provided before analysis is performed.

Shift uses GenAI to help determine liability based on the insured’s description of a collision. Watch the video.

Continuous claim monitoring

As details about a claim develop, the additional information provided is shared in the batch cycle to enable continuous assessment of the claim for subrogation potential. This could include a new reason for subrogation potential or an update such as a supplemental payment on the same claim that could further increase the recovery amount.

Automated claim monitoring

View alerts and reasons

The results of the above analysis resolve to an indication of the recoverability summarized into an alert score. This score considers all of the factors analyzed including the estimated liability, the computed individual exposures and the rules in effect based on the state.

An intuitive interface is provided for handlers to view the alerts and assess the recovery opportunities. Along with an estimate of liability and exposures, Shift Subrogation discloses full reasoning for the subrogation detection with each element of the analysis isolated and the logic for its importance. With this fully explainable context, handlers can manage and assign the alerts including disposition notes for reference.

Shift Subrogation drives new recoveries in top 25 insurers

A top 25 P&C insurer was looking to improve the recovery process by introducing more automation. Shift Subrogation is now assisting adjusters to more accurately and consistently apply state specific statute of limitations, deductible conditions, etc. to identify and accelerate recovery. The solution is generating net new recovery opportunities often ahead of the claims teams referring alerts.

Shift Subrogation has offered continuous improvement to the insurer since they deployed the solution with a recurring average recovery of over $1 million per month. The solution identifies previously missed opportunities, including individual claim exposures for PIP and Medpay.