With inflation increasing the cost and frequency of fraud, there is a real risk to the important investments insurers have been making in customer satisfaction and digital transformation. The good news is that insurers are starting to build a new set of anti-fraud tools to fight the threat and better serve their policyholders. This new, advanced anti-fraud approach is centered on unified actions from policy and claims organizations to collectively spot, prevent and defend against fraudsters.

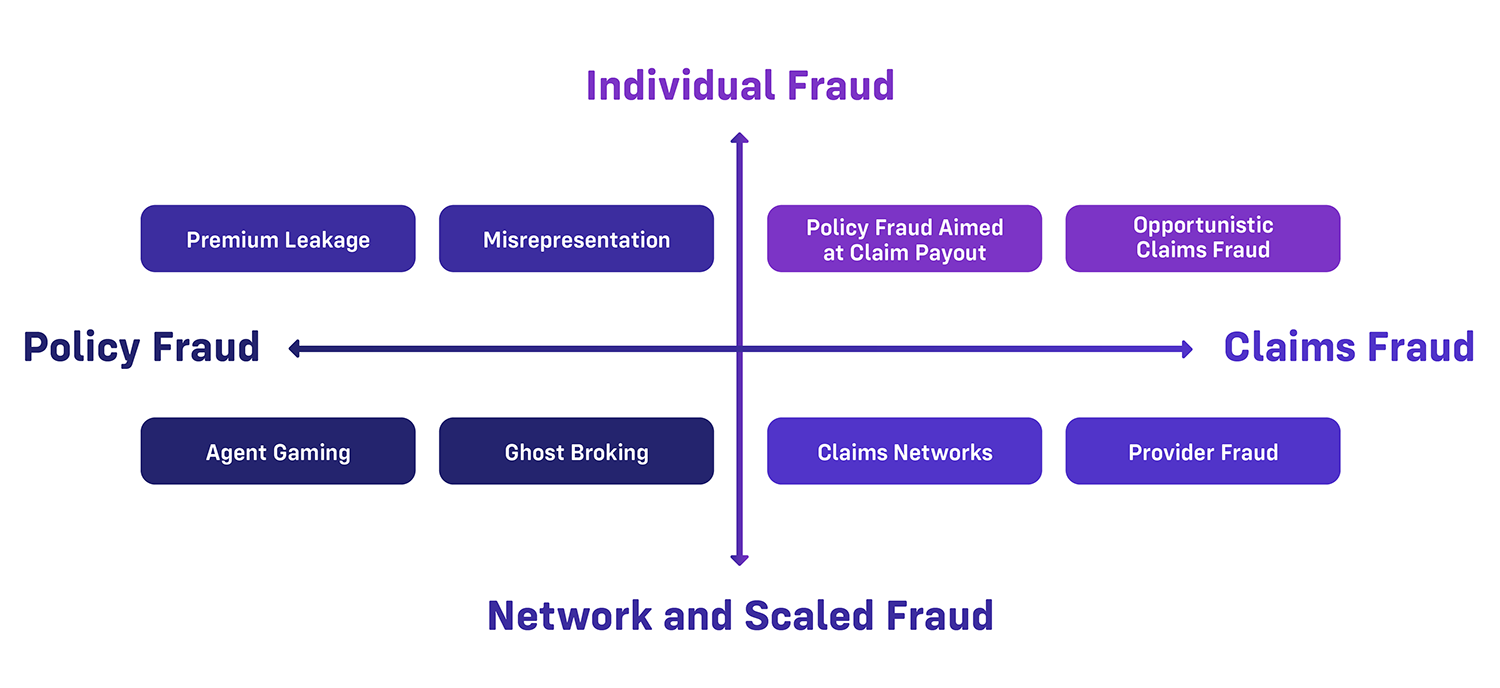

Insurance fraud methods and the gap exploited by fraudsters

For a long time, Underwriting and Claims organizations have functioned as if they each have their own, unrelated fraud to address. For Underwriters, application fraud, including misrepresentation and identity theft, has been a focus, with the primary goal of ensuring correct premiums without slowing growth. Claims fraud teams, on the other hand, have focused on exactly that: false claims or overstated damage and injury in order to receive an unjustified payout from the insurer.

In recent years, claims organizations have increased their focus on major case investigation, uncovering “networks” of related fraudulent policies and claims. These networks, sometimes spanning hundreds of “policyholders,” are a scaled approach to cheating insurers, and are often found as a mix of paid claims on expired policies, open claims on active policies, open claims yet to be paid, and policies without any claims filed.

Types of insurance fraud

While clear action plans are taken on claims investigations, a gray area exists for policies connected to networks where no fraudulent claims have yet to be filed. These latent policies are ticking time bombs for an insurer's loss ratio, either because there is an intent to file fraudulent claims or because of unknown exposures resulting from policy fraud. Shift’s recent review of networks with insurers around the globe found that fraudulent policies could eventually cost as much as $15,000 in each fraudulent claim.

Yet, roles and responsibilities of both policy and claims teams can leave these pools of high-risk policies unaddressed. Claims investigators, by definition, are focused on claims investigations, and are not reviewing policies before a claim is submitted. On the other hand, underwriting teams are focused on customer expectations for ease and speed, opting for automated risk detection during the applications and policy phase. This approach does stop some of the fraud at the door, but leaves open the possibility of innocent-looking policies waiting for the opportunity to file false claims.

A new approach to connected writing

In reality, Underwriting and Claims organizations have common benefits in stopping fraud; more fraud and risk stopped in Underwriting improves Claims SIU efficiency, freeing investigators to tackle major cases with increased impact. More fraud stopped in Claims means more investment in portfolio growth and customer satisfaction. That’s why innovative insurers are challenging the status quo and building a new approach that connects underwriting and claims teams in the fight against fraud. Teams are achieving this by:

-

Integrating Claims and Policy Data

Many insurers know the headaches of just aligning system feeds across policy and claims in the first place, let alone implementing relevant information. That’s one of the many reasons why Shift’s first step with clients is to map and unify an integrated data set of insurer policy and claims data, as well as external data sources. Insurers with a shared, complete picture of policyholders are able to make better decisions about potential policy or claims risk -

Applying Advanced AI in both Underwriting and Claims

Underwriting and claims teams are serious about uncovering hidden risk and fraud, and Shift customers have found that certain hidden risks uncovered by AI, like policies with identity similarities, are better investigated before claims are filed. That’s because resulting claims may actually be an honest consumer filing an honest claim on a ghost broked policy. This can leave insurers with either high loss ratios on policy networks, reputational damage to their brand, or both. -

Deploying Fraud Detection Synergy

Once unified data and AI detection are in place, insurers are operationalizing risk detection by aligning key decision points, such as point of quote, policy inception, first notice of loss (FNOL), etc., L, with operational investigation steps. For example, if a fraud network is identified during a claims investigation, that information immediately flows to Underwriting, so that team can take appropriate action. Similarly, policies associated with a network detected by Underwriting can be tagged for SIU review should any of those policyholders submit a claim. -

Building Joint Fraud Teams

Beyond logistics, Insurers are realizing that it may make more sense to fight fraud holistically across policy and claims, rather than silo-ing teams based on underwriting or claims functions. These joint fraud teams share a mission for stopping fraud throughout the policy lifecycle, and can then specialize complex fraud detection, such as network analysis, to a single team, rather than delineating between policy and claims fraud.

Holistic Fraud Maturity

|

Early |

Moderate |

AdvanceD |

|

|

Data |

Ad-hoc data sharing between claims investigators and underwriting organization |

Structured data feeds between claims and policy core systems |

Insurers use AI to create a uniform data layer for analytics shared by underwriting and claims teams |

|

Analytics |

Manual review of shared data for investigational support on an as needed basis |

Automated business rules for fraud identification from policy or claims data |

AI-powered detection that uses machine learning to enhance risk alert accuracy for both underwriting and claims |

|

Organization |

Ad-hoc underwriting/claims discussion on anti-fraud activities |

Collaboration between teams on improving overall fraud detection |

Task force dedicated to holistic fraud detection across insurance lifecycle |

Building a unified approach to policy fraud: where teams can start

1. Identify a Cross-Functional Champion

While some insurers have already taken the step to create joint policy/claims fraud teams, most insurers can start by simply identifying a champion from both policy and claims to work together on quick wins. What are the common policy fraud trends spotted by SIU? How could the Underwriting organization make use ofSIU findings in a consistent way? What’s the best way for underwriters to receive regular data updates from SIU? These smaller tasks can start building unity and rapport across the organization.

2. Start a Plan for Shared Policy and Claims Fraud Data

A smart first choice for cross-functional collaboration is to enhance application and new business Underwriting process. Since the optimal time to detect scaled fraud is before a policy is bound, an easy place to start is with a shared list of known network fraudsters from SIU investigators. This can be used before a policy is bound, but also to review policies-in-force and take appropriate actions.

3. Leverage Advanced AI to Uncover Fraudsters

Of course, fraudsters are trying to stay hidden, so leveraging robust AI risk detection allows Underwriting and Claims teams to uncover and investigate more fraud and risk together. This way, whether networks or individuals, policy or claims fraud, insurer teams are collectively stopping more fraud, growing the business, and delivering customer satisfaction.

Get in touch with us today to discover how Shift can help revolutionize the way your insurance organization operates. With Shift, you can access data and insights that enable better decision-making, improve customer experiences, and combat fraudulent activity.