James Tesdall is a well-versed insurance professional with 25+ years experience working in the industry for large national insurance carriers in the United States.

He started his career taking FNOL in the claims service center before transitioning to underwriting. James has worked as a front-line underwriter, led underwriting teams/divisions, and also helped build & launch Nationwide Private Client as a new start-up entrant to the affluent and high net worth personal lines market. His underwriting experience includes standard personal lines, high net worth personal lines, small commercial, and middle market commercial business. James has also held various leadership roles in both operations and sales throughout his insurance career.

Let’s start by talking about your areas of expertise. What are you most passionate about?

I love and truly enjoy helping others achieve their personal and professional objectives. This might mean partnering with a broker to place a piece of business or coaching new associates about the art of underwriting. Lately, it has meant helping insurers strengthen their decision-making by becoming more efficient and leveraging the power of AI, data and machine learning. My passion is rooted in helping others achieve more.

How did you get started in underwriting?

Underwriting is responsible for driving profitable growth within an insurer’s organization. I transitioned to underwriting because I wanted to have a direct impact on the quality of the portfolio and the book of business being written while also helping each carrier I worked for achieve their top line objectives.

I was also drawn to the relationship aspect of the business. It is a lot of fun to partner with your distribution channel (agents) to help them write business. Underwriting is a rewarding profession that adds value to the insurer, its distribution partners, and its policyholders.

What would you consider to be your finest achievement?

Two things come to mind…

First, it is humbling when coworkers, peers and customers seek you out for advice. That is my personal gauge on whether or not I am making an impact and adding value. This level of acknowledgment is something I do not take for granted, but cherish and strive to continuously deliver.

Second, I value the ground-level experience I had in helping a start-up insurance carrier. Starting from zero, I worked with a talented team of entrepreneurs to build the brand, operational procedures, distribution, and hiring. In the beginning, you are selling a dream – a vision of what the future can be. I am forever grateful for the early adopters that believed in me and the brand I represented. Believing in the possible is a powerful thing.

What do you think are the biggest challenges currently facing the insurance industry?

Insurance is complex and the challenges vary based on the type of insurance being offered, the geography, and the legal and regulatory environments. There are commonalities, however, that are shared amongst many insurance carriers. Customer centricity, employee engagement, operational efficiency, and driving profitable growth are critical to the health of an insurer’s business. Every decision made by an insurer should be rooted in solving for (or, advancing) one of these four key objectives.

At Shift Technology, we help underwriters meet marketplace demands of speed and ease of use by providing a powerful tool that leverages data, AI and machine learning to enable better-informed decisions, faster, across the entire policy life cycle.

How can Shift Technology help insurers make a difference?

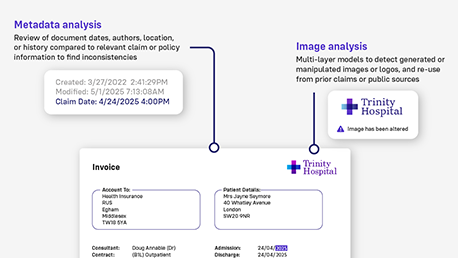

I am glad you asked. Shift detects anomalies, policy inaccuracies, misrepresentation, and fraud (including fraud networks) to help insurers reduce portfolio risk and optimize pricing. We bring data-driven insights to the forefront at the time policy decisions are being made by the underwriting team. Customers appreciate the flexibility of our solution, which complements their internal workflows and helps underwriters zero in on suspicious policies and suspicious quotes while freeing them up to focus on other parts of the business.

Shift is 100% dedicated to insurance. We are a partner to insurers with a driving mission to enable them to make better decisions for their customers using data and AI.

Want to learn more about James Tesdall and how his expertise helps insurers navigate the future? Contact us to set up a conversation with Shift subject matter experts.