Reimagine Risk Detection For Your Underwriting Business

Leverage AI for improved revenues and customer experiences

Better decisions — from quote to renewal

You help manage the risks of everyday life, while we help you manage the decision making process throughout the policy lifecycle.

Combining AI and deep insurance expertise we look to deliver fast and accurate outcomes, so you can be there for your customers, at a national scale, every second of the day.

Shift Insurance Decisioning Platform

SHIFT IA-Based platform

The AI-based platform helps insurers dramatically scale the impact contextual decisions can deliver across claims and underwriting — while enhancing their ability to screen out claims fraud.

Our solution affects claims and policyholders from pre-bind to renewal, creating a fairer and more streamlined process for legitimate claimants, allowing your workforce to avoid repetitive manual effort and focus on the details that drive impactful ROI.

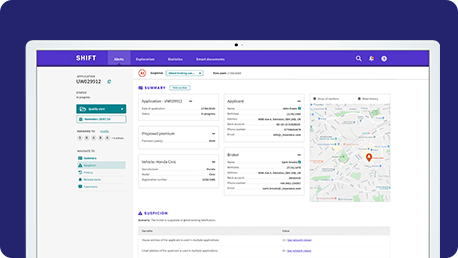

Shift Underwriting Risk Detection

Underwriting solution

Shift Underwriting Fraud Detection is an AI analysis solution that enables insurers to flag applicants who supply inaccurate or false information, which dramatically reduces the risk of misrepresentation in the short term, and claims later in the life of the policy.

-

AI-powered identification of potential fraud and misrepresentation at the point of underwriting

-

Aggregate scoring with detailed supporting information to help underwriters make more informed decisions quickly

-

Internal & 3rd party data integration enables insurers to evaluate and identify fraudulent entities accurately, even those who attempt to obscure their identities

-

Integrates with insurer core systems & underwriting tools

Shift makes it easy to start making better decisions

Busting Ghost Brokers

using uNderwriting risk detection

Getting insurance is supposed to have gotten easier over the years. Online insurance brokerages and price comparison tools have made it easier to get the best prices, which means that the traditional role of insurance agents and brokers has evolved. In Germany, for example there are 33% fewer insurance agents than there were 10 years ago.

The prevalence of online channels means that it’s easier for insurers to reach customers directly—and it’s easy to get insurance without seeing anyone face-to-face. This convenience has been co-opted, however, by bad actors known as ghost brokers.

-3.png?width=458&height=258&name=Untitled%20design%20(10)-3.png)

Exceed Expectations with Underwriting Risk Detection

The head of innovation at one of Shift’s European P&C clients recently began a review across their business to identify applications for Shift’s AI decisioning capabilities. Having seen the impact of Shift Claims Fraud Detection, the insurer’s head of policy service asked about the potential to address challenges for their Underwriting Team.

Shift accepted the challenge and implemented a limited proof of concept in just 3 months. Following the results obtained in 2 months of analysis, with Shift's AI and software, the client extended the Underwriting risk detection solution to its entire automotive portfolio.

Shift Underwriting Risk Detection

Underwriting Solution

Let underwriters make better decisions about potential misrepresentation, fraud, and other policy risks across the life of a policy. Built on the Shift Insurance Decisioning Platform, the Underwriting Risk Detection product is powered by AI to help underwriters mitigate fraud, optimise pricing, and spot policy risk trends like agent gaming in the portfolio.

Learn how Shift can help you make better underwriting decisions.

Our Experts:

-2.png?width=200&name=Untitled%20design%20(14)-2.png)

Jeff Manricks, Sales Director EMEA North

-4.png?width=200&name=Untitled%20design%20(13)-4.png)

Ben Lazarevic, Business Development Representative