This report explores how advanced AI and document analysis are revolutionising the insurance industry by combating digital fraud. It highlights the increasing sophistication of fraudulent activities, such as staged accidents and manipulated healthcare invoices, and showcases innovative AI technologies like generative AI, machine learning, and advanced document analysis that insurers are leveraging to detect and prevent these threats. With real-life use cases and insights into the impact of digital fraud, this document is a must-read for anyone interested in understanding how cutting-edge technology is reshaping risk management and enhancing operational efficiency in insurance. Dive in to discover how insurers are staying one step ahead of fraudsters.

How advanced AI and document analysis is helping insurers fight digital risk

Producing artefacts and operating AI technology has now truly moved out of the hands of the very technical into the realm of the everyday person. With tools like Stable Diffusion 2, ChatGPT and Murf readily available for individuals to create content, documents, videos and audio files on their phones with basic skills, there are very few barriers to leveraging these kinds of technology for ill.

This poses a completely new thread for insurers as both organized and opportunistic fraudsters take their approach to the next level. The phrase "fight fire with fire" certainly applies. Let's look at some of the latest fraudulent uses of these and how the technology can be used in return.

Applicable technology

Generative AI

Machine Learning (ML)

Network Analysis

Supervised Learning

Unsupervised Learning

Entity Resolution (or Reconstruction)

Reinforcement Learning

Document Analysis

Real life use cases of how these technologies have been leveraged to detect and prevent a multitude of advanced document fraud scenarios for insurers.

Exaggeration of damage

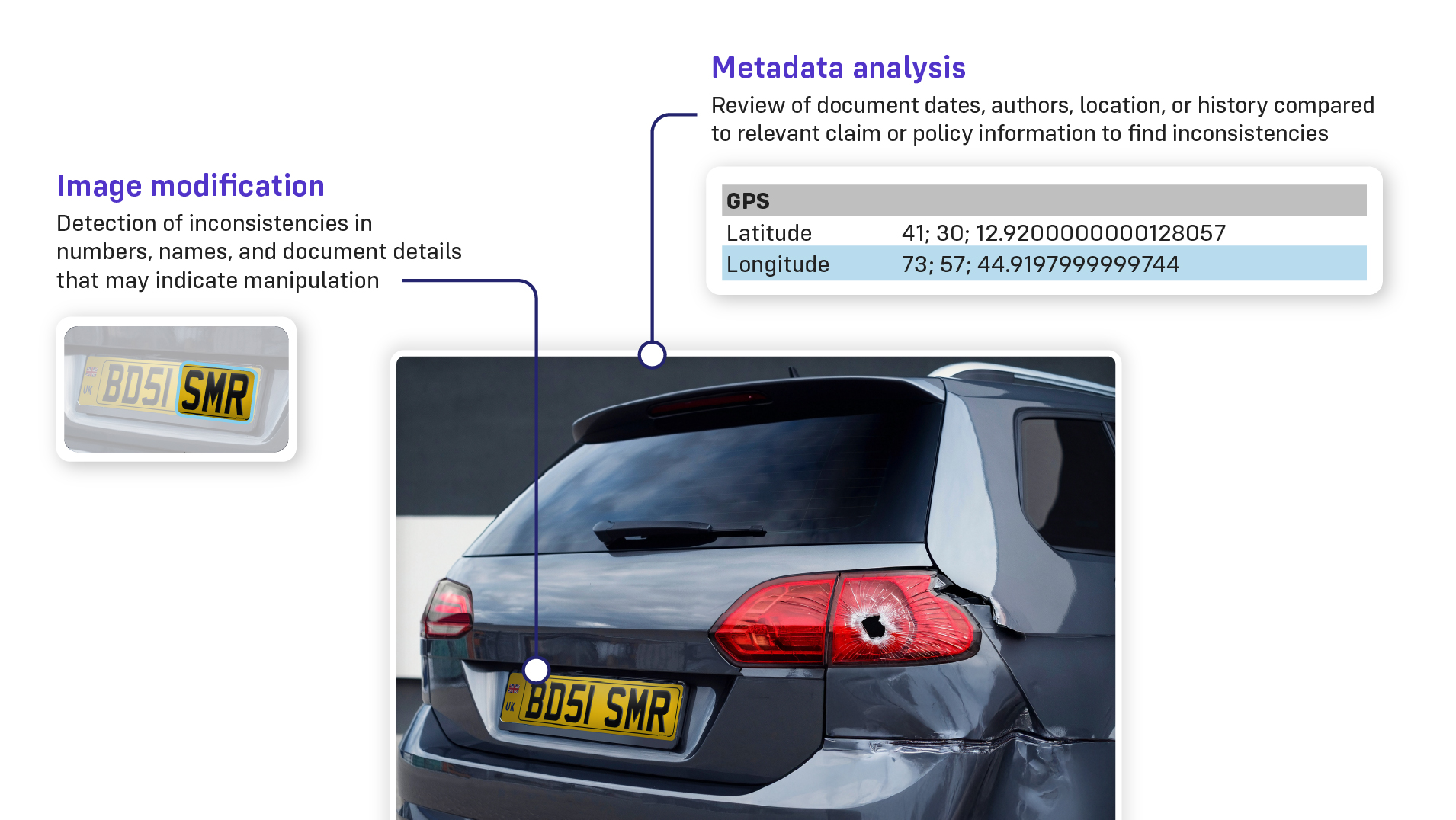

Fraud method: Organised crime rings are frequently staging motor accidents, declaring significant damage and using images of other cars and invoices and/or generated images as evidence.

Impact: The insurer pays an inflated claim cost for what in reality is minor damage, and over 100s of organised claims is significant leakage.

Advanced AI approach: Shift technology can detect manipulated and fake images and receipts quickly, alerting handlers of the most suspicious cases as a priority.

Analysis of handwritten accident reports and sketches

Fraud method: Motor accident reports are regularly submitted using standard paper based forms containing different drivers handwriting and pencil sketches of the scene and scenario. Even on genuine forms, mistakes and inconsistencies are rife. The fraudsters take advantage of the fact that manual checks of all details are near impossible, as they alter official statements, vehicle details, damage descriptions and more to make fraudulent gains.

Impact: Insurers settling for at fault motorists risk paying out significant amounts more than they are liable for, eventually increasing the premium of the genuine customers that they want to retain.

Advanced AI approach: Advanced OCR from Azure Document Intelligence can consume handwritten text and extract it into structured data as shown below: Shift document intelligence can identify “Areas of interest” in the document to extract further information from checkboxes for example:

Healthcare invoice manipulation

Fraud method: Fraudulent beneficiaries are able to use Gen AI and other tools to create completely ficticious documents and invoices for care and treatments they never received to get quick cash back.

Impact: Amongst an employee benefits scheme for example, this fraudulent practice has been seen to spread amongst employees causing the insurer potentially millions of euros in addtional claim cost.

Advanced AI approach: Character recognition pulls out key document information to make comparisons and discover anomalies. Shift has found inconsistent VAT figures, dates that do not match the official document reference and many more detailed checks.

This example shows how a fraudster has changed the date of the invoice but not changed the document reference number which also contains date details.

Automating lengthy manual searching

Fraud method: Fraudsters use AI tools to create clever artefacts to embellish their claim and reuse previous documents and images, gleaning materials from the internet.

Impact: Fraud in domestic property is thought to be as many as 1 in 10 claims, and the reuse of images as evidence is easy for fraudsters to achieve and time consuming for insurers to check.

Advanced AI approach: Instant document and image comparison with entire claims history database and external sources highlighting potential image reuse.

Transforming unstructured data to support very busy claim periods

Scenario: Fraudsters often take advantage of busy periods for insurers, such as floods, earthquakes and freak weather incidents. They hide incorrect details in unstructured data and documents that require heavy manual data transformation and checking, knowing that the insurer will fast track many claims due to the spike in volume and the need to get payments to those genuinely in need.

Impact: As many as 90% of claims can need manual intervention due to unstructured data, some of our customers can receive twice as many claims in a natural disaster scenario in 24 hours than they do in one year. That results in at least 2 years worth of fraudsters (and probably more opportunistic ones as well) getting payouts in a few short weeks, inflating the cost of the natural disaster well beyond the actual loss.

Advanced AI approach: Shift has deployed multiple advanced technologies to transform completely unstructured data into, firstly, structured data and then into insights and recommendations.

The Shift platform uses Azure OCR to turn unstructured PDF data into codified and categorised data, identifying key pieces of data from long unstructured documents across thousands of different layouts.

Once the key fields are codified and held in digital records as individual data pieces, Gen AI (CHAT GPT 3.5) is used to improve the accuracy of the codified data where possible. Realtime Gen AI calls fill any gaps in the data where parts of a word are missing or obscured in the original and AI checks other data stores to embellish the records with additional data.

The codified, cleaned and complete data can then be passed seamlessly through AI scenarios to detect fraud, and fast track payments to genuine customers with no intervention.

Travel cancellation for fake illness

Fraud method: Opportunistic fraudsters, not wanting to waste holiday money when they accidentally double booked their diaries, will claim sickness prevented them from going.

Impact: Insurers are left with paying out for someone else’s mistake usually due to lack of robust evidence to prove the fraudster is in the wrong.

Advanced AI approach: OCR quickly analyses the handwritten form, structures the data and makes basic checks such as dates of first symptom, travel and treatment dates and patient details to instantly flag anything that looks suspicious or inconsistent before claims are paid.

Conclusion

Digital fraud is increasing in both volume and complexity passing undetected through rules based and manual checks. Advanced technical fraud requires very advanced technical detection that is always multiple steps ahead and learning tomorrow’s potential fraud from today’s patterns.

To learn more about Shift's AI-powered document fraud detection how insurers can leverage advanced document fraud detection AI, contact us or schedule a demo.

Download the full report for our complete findings and analysis