AI-Powered Document Fraud Detection

AI-powered document fraud detection is becoming essential as fraudsters increasingly use generative tools to create or alter claims documents. Insurers are now leveraging advanced document fraud detection AI to identify fake invoices, manipulated images, and altered handwritten forms that often slip through manual review. By applying AI-powered document fraud detection across claims workflows, insurers can detect deception earlier, reduce losses, and protect genuine policyholders more effectively.

How advanced AI and document analysis is helping insurers fight digital risk

AI technology has now truly moved out of the hands of the very technical into the realm of the everyday person. With tools like Midjourney, DALL-E 3, or Firefly readily available for individuals to create content, documents, videos and audio files with basic skills, there are very few barriers to leveraging these kinds of technology. Unfortunately, it means that individuals can use these AI technologies to generate or manipulate documents and images used in insurance.

This poses a completely new thread for insurers as both organized and opportunistic fraudsters take their approach to the next level. The phrase "fight fire with fire" certainly applies. Let's look at some of the latest fraudulent uses of these and how the technology can be used in return.

Applicable technology

Generative AI

Machine Learning (ML)

Network Analysis

Supervised Learning

Unsupervised Learning

Entity Resolution (or Reconstruction)

Reinforcement Learning

Document Analysis

Real life use cases of how these technologies have been leveraged to detect and prevent a multitude of advanced document fraud scenarios for insurers.

Exaggeration of damage

Fraud method: Organized crime rings around the world stage motor accidents, declaring damage. Using AI tools, the accidents can be exaggerated, with images of other cars and invoices, manipulated invoices, or generated images provided as evidence.

Impact: The insurer pays an inflated claim cost for what in reality may be minor damage, and over hundreds of organized claims is significant leakage.

Advanced AI approach: Shift uses Generative AI to classify the type of image or document, and then uses multi-layer predictive models to detect generated or manipulated images, and re-use from prior claims or public sources, alerting handlers of the most suspicious cases as a priority.

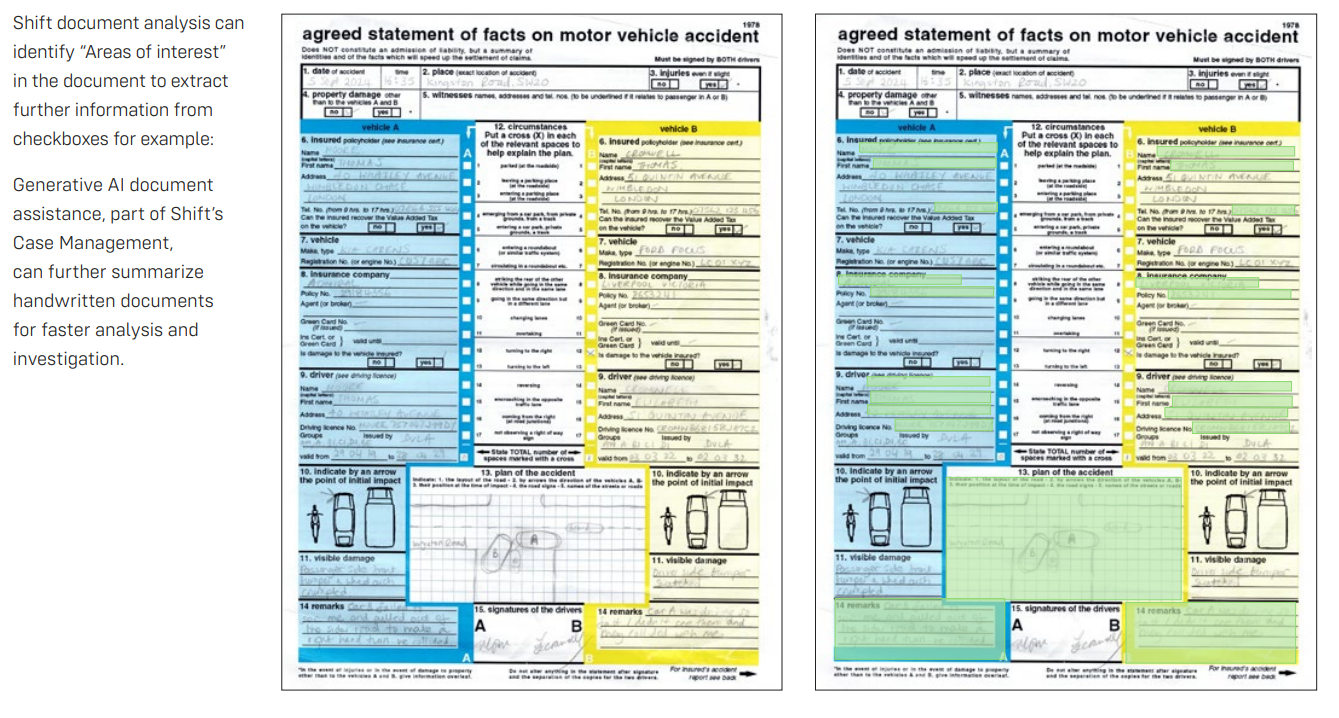

Analysis of handwritten accident reports and sketches

Fraud method: Auto accident police reports are regularly submitted using paper forms containing handwriting and pencil sketches of the scene and scenario, which often contain honest mistakes and inconsistencies. As a result, bad actors take advantage of the fact that manual checks of all details in a report are time consuming, altering official statements, vehicle details, damage descriptions and more, with the hopes of deceiving.

Impact: Insurers settling claims risk paying out significant amounts more than they are liable for, eventually increasing the premium of the genuine customers that they want to retain.

Advanced AI approach: Generative AI classification followed by advanced OCR from Azure Document Intelligence can consume handwritten text and extract it into structured data.

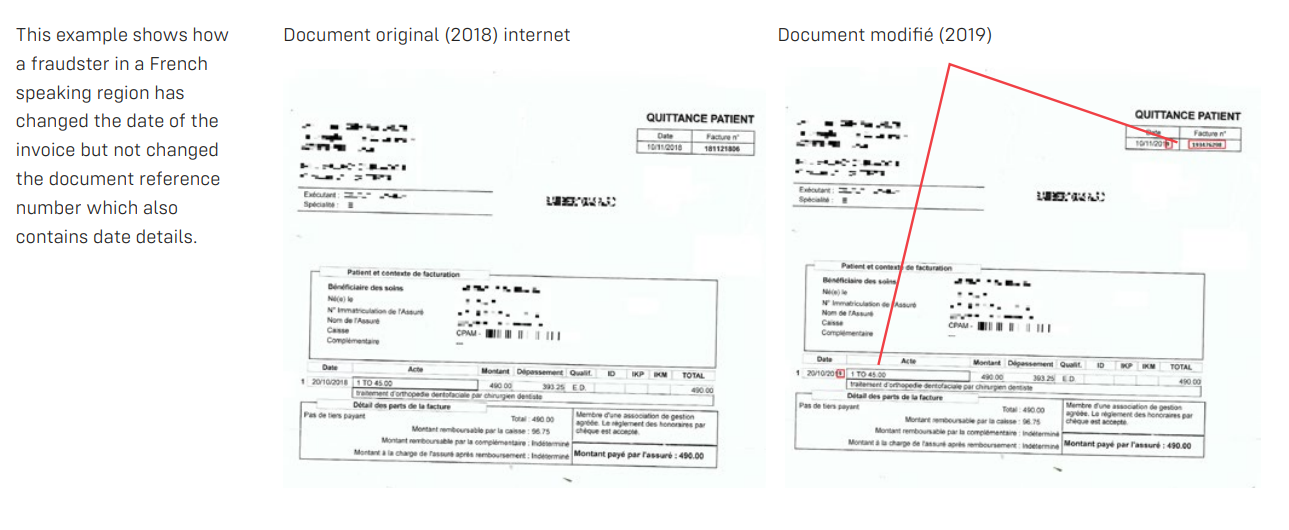

Worker’s Compensation Disability invoice manipulation

Fraud method: Fraudulent worker’s compensation and employee disability benefits beneficiaries are able to use Generative AI and other tools to create completely fictitious documents and invoices for care and treatments they never received to get quick cash back.

Impact: Instances of manipulation networks within an employer have seen insurers face potentially millions in additional claims cost.

Advanced AI approach: Character recognition pulls out key document information to make comparisons and discover anomalies, along with text inconsistency. Shift has found inconsistent invoice figures, dates that do not match claims and other inconsistency checks.

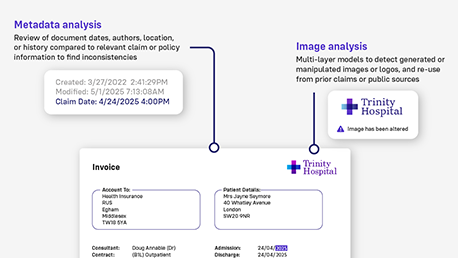

Automating lengthy manual searching

Fraud method: Fraudsters use AI tools to create clever artefacts to embellish their claim and reuse previous documents and images, gleaning materials from the internet.

Impact: Fraud in domestic property is thought to be as many as 1 in 10 claims, and the reuse of images as evidence is easy for fraudsters to achieve and time consuming for

insurers to check.

Advanced AI approach: Instant document and image comparison with entire claims history database and external sources highlighting potential image reuse.

Travel cancellation for fake illness

Fraud method: Opportunistic fraudsters, not wanting to waste vacation money when they accidentally double booked their schedules, will claim sickness prevented them from going.

Impact: Insurers are left with paying out for someone else’s mistake usually due to lack of evidence to prove the fraudster is in the wrong.

Advanced AI approach: OCR quickly analyses the handwritten form, structures the data and makes basic checks such as dates of first symptom, travel and treatment dates and patient details to instantly flag anything that looks suspicious or inconsistent before claims are paid.

Conclusion

Digital fraud is increasing in both volume and complexity passing undetected through rules based and manual checks. Advanced technical fraud requires very advanced technical detection that is always multiple steps ahead and learning tomorrow’s potential fraud from today’s patterns.

To learn more about Shift's AI-powered document fraud detection how insurers can leverage advanced document fraud detection AI, contact us or schedule a demo.

.jpg)